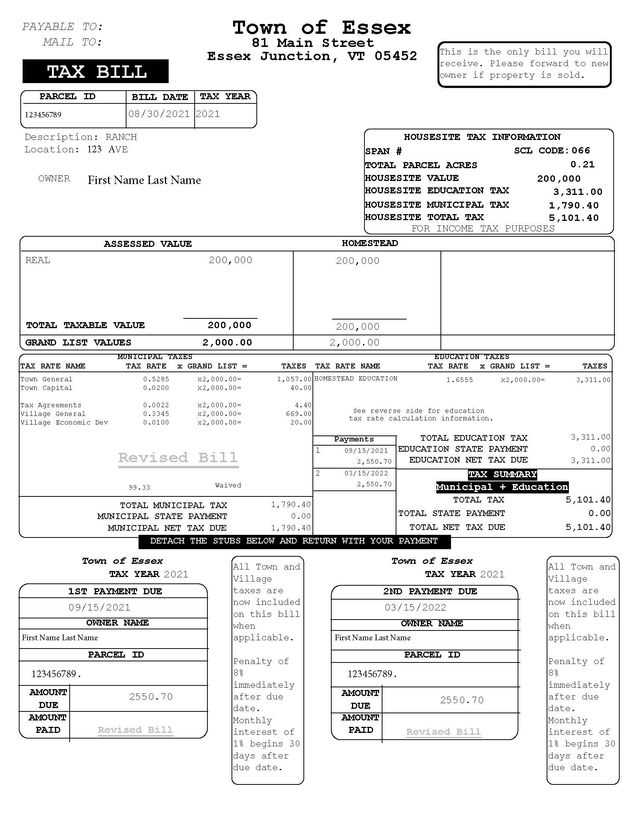

vermont income tax withholding

101-1200 - quarterly filings. If your withholding isnt required to be withheld at a certain percentage youre able to claim amounts on Form OR-W-4.

A Complete Guide To Vermont Payroll Taxes

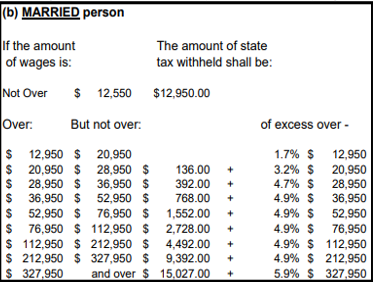

Withholding Tax Computation Rules Tables and Methods.

. 1201-25000 - monthly filings. This publication contains the wage bracket tables and. Up to 100 - annual filing.

The income tax withholding for the State of Vermont includes the following changes. NYS-50-T-NYS 122 New York State withholding tax tables and methods. Withholding on Form OR-W-4 line 3 in addition to the per - centage.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the. The annual amount per allowance has changed from 4400 to 4500. Tax year 2022 Withholding.

When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding.

Vermont Department Of Taxes Montpelier Vt Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

Form In 111 Vermont Income Tax Return

In 151 Extension Of Time To File Vt Individual Income Tax Return

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Wht 436 Fill Out Sign Online Dochub

Free Vermont Payroll Calculator 2022 Vt Tax Rates Onpay

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State Withholding Form H R Block

Complete And E File Your 2021 2022 Vermont State Tax Return

Form In 111 Fillable Vermont Income Tax Return

State W 4 Form Detailed Withholding Forms By State Chart

Vt Dept Of Taxes Vtdepttaxes Twitter

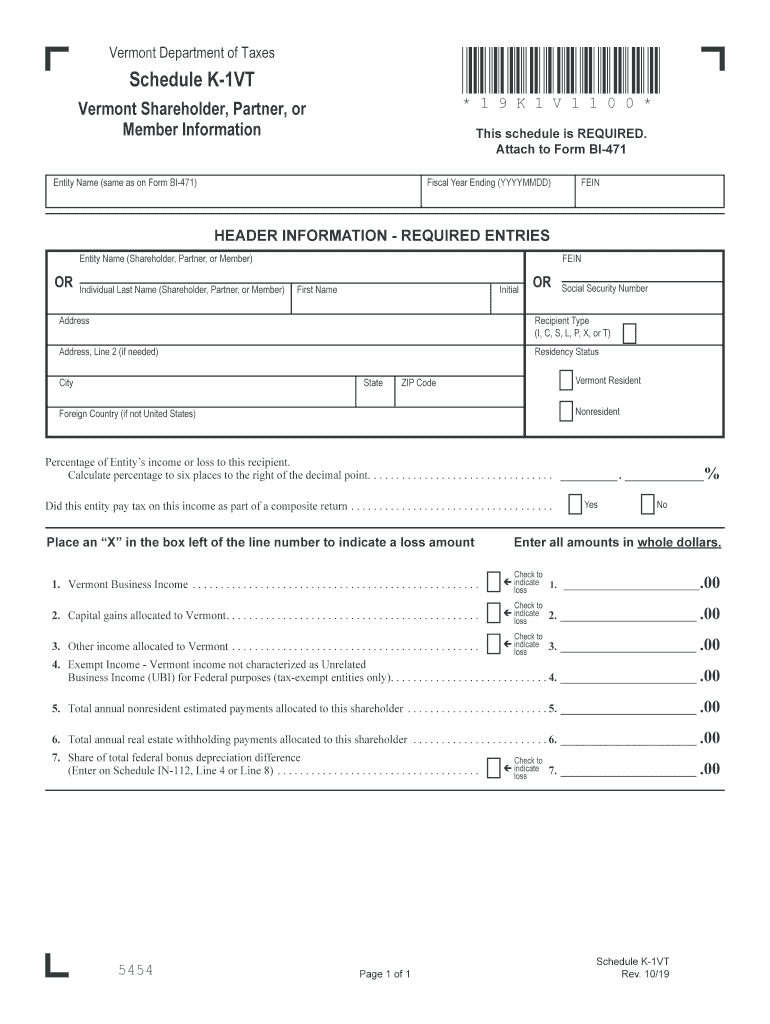

2019 Form Vt Schedule K 1vt Fill Online Printable Fillable Blank Pdffiller

Vermont Paycheck Calculator Tax Year 2022